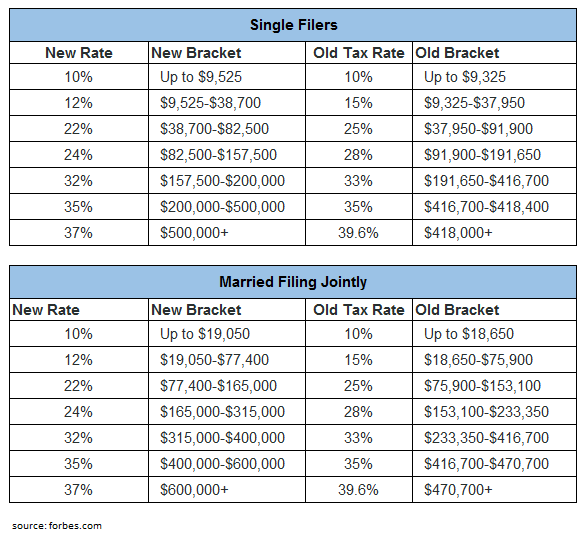

Tax Brackets 2025 Single Vs Married Conclusive Consequent Certain. Find the 2025 tax rates (for money you earn in 2025). For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for.

Find the 2025 tax rates (for money you earn in 2025). The old tax regime features progressive tax slabs that vary based on age: Individuals below 60 years have a basic.

Source: jacobdobbiea.pages.dev

Source: jacobdobbiea.pages.dev

2025 Tax Brackets Married Filing Separately Married Jacob A. Dobbie Single, married filing jointly, married filing. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for.

Source: yasminhwilliamson.pages.dev

Source: yasminhwilliamson.pages.dev

Tax Brackets 2025 Married Vs Single Yasmin H Williamson Find the 2025 tax rates (for money you earn in 2025). For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for.

Source: willyfthginelle.pages.dev

Source: willyfthginelle.pages.dev

Tax Brackets 2025 Married Jointly Single Erika Shirlee The old tax regime features progressive tax slabs that vary based on age: Individuals below 60 years have a basic.

Source: ricardodebos.pages.dev

Source: ricardodebos.pages.dev

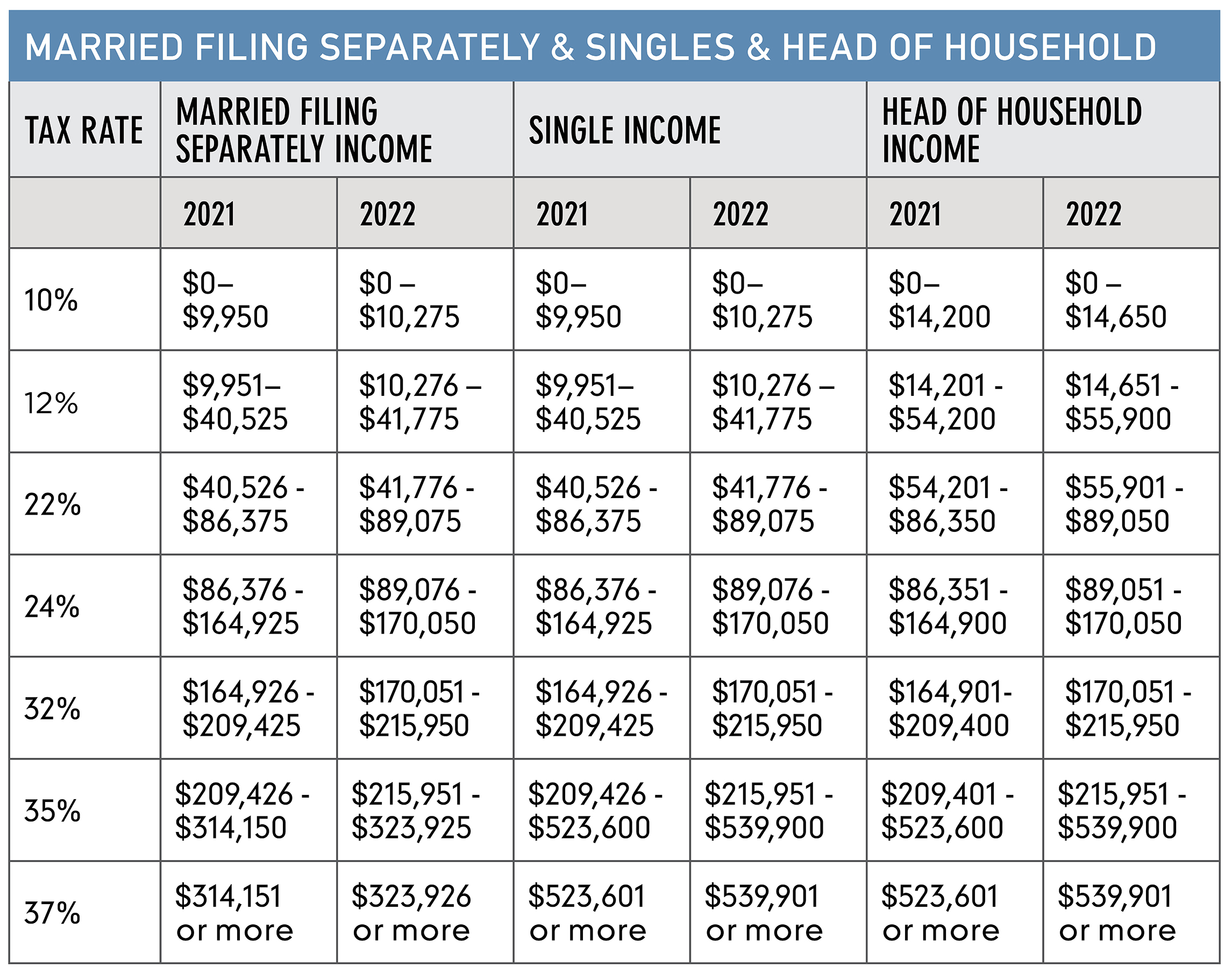

Tax Brackets 2025 Married Vs Single Ricardo Debos Individuals below 60 years have a basic. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville Find the 2025 tax rates (for money you earn in 2025). For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for.

Source: lucyseymourw.pages.dev

Source: lucyseymourw.pages.dev

Tax Brackets 2025 Vs 2025 Lucy Seymour To figure out your tax bracket, first look at the rates for the filing status you plan to use: The old tax regime features progressive tax slabs that vary based on age:

Source: amelialopes.pages.dev

Source: amelialopes.pages.dev

Tax Brackets 2025 Married Vs Single Amelia Lopes The clearest example of how your taxes will. For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for.

Source: christopherfosberyb.pages.dev

Source: christopherfosberyb.pages.dev

2025 Us Tax Brackets Married Filing Jointly Images References For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for. Single, married filing jointly, married filing.

Source: anthonykgeoghegan.pages.dev

Source: anthonykgeoghegan.pages.dev

Tax Brackets 2025 Married Vs Single Anthony K. Geoghegan For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for. To figure out your tax bracket, first look at the rates for the filing status you plan to use:

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville The old tax regime features progressive tax slabs that vary based on age: Individuals below 60 years have a basic.

Source: alicalynasl.pages.dev

Source: alicalynasl.pages.dev

2025 Tax Brackets Married Filing Separately Calculator Alica L. Lynas For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $626,350 ($751,600 for. The old tax regime features progressive tax slabs that vary based on age:

Source: orelhjkpollyanna.pages.dev

Source: orelhjkpollyanna.pages.dev

2025 Tax Brackets Married Jointly Vs Single Dedie Eulalie Single, married filing jointly, married filing. The clearest example of how your taxes will.