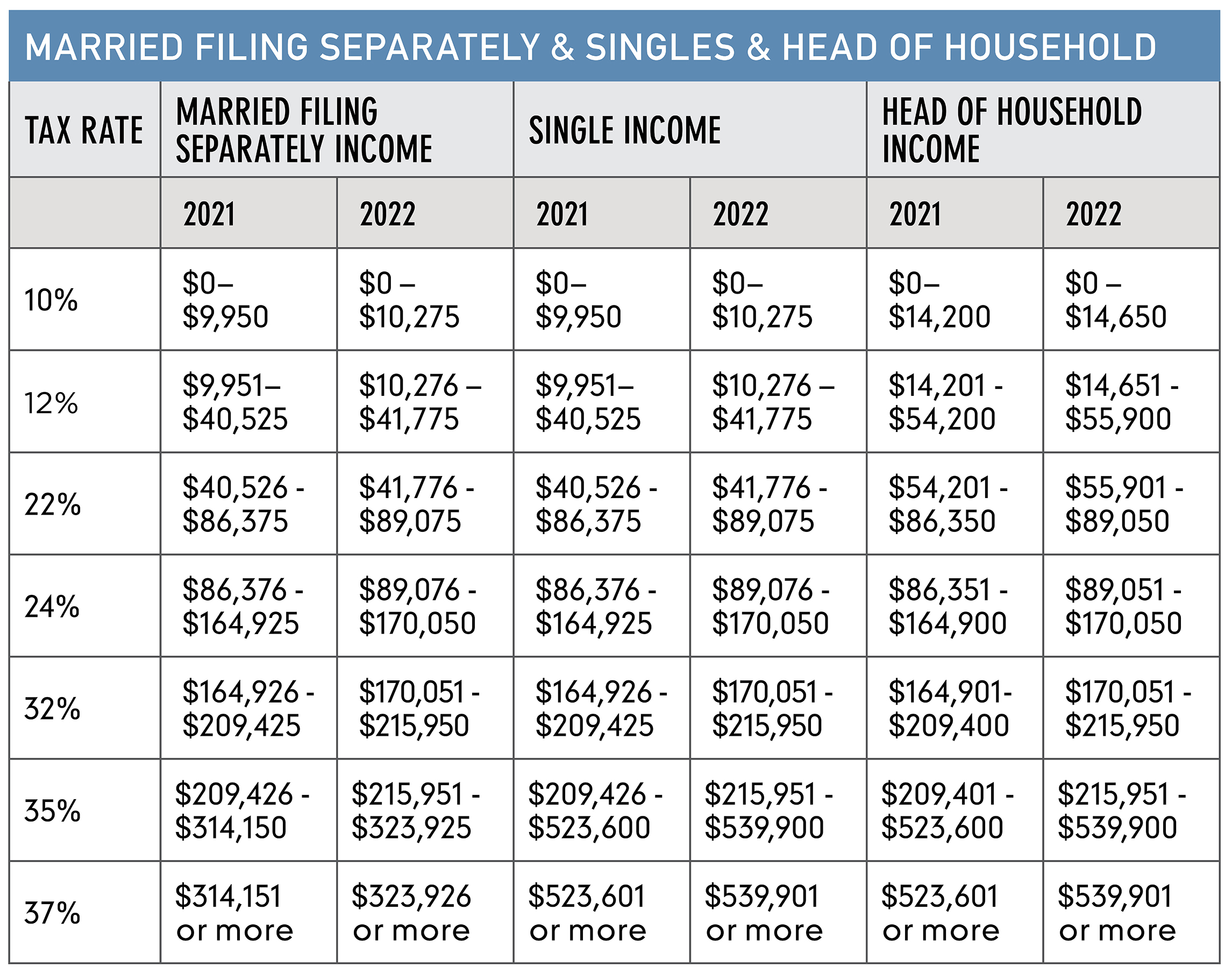

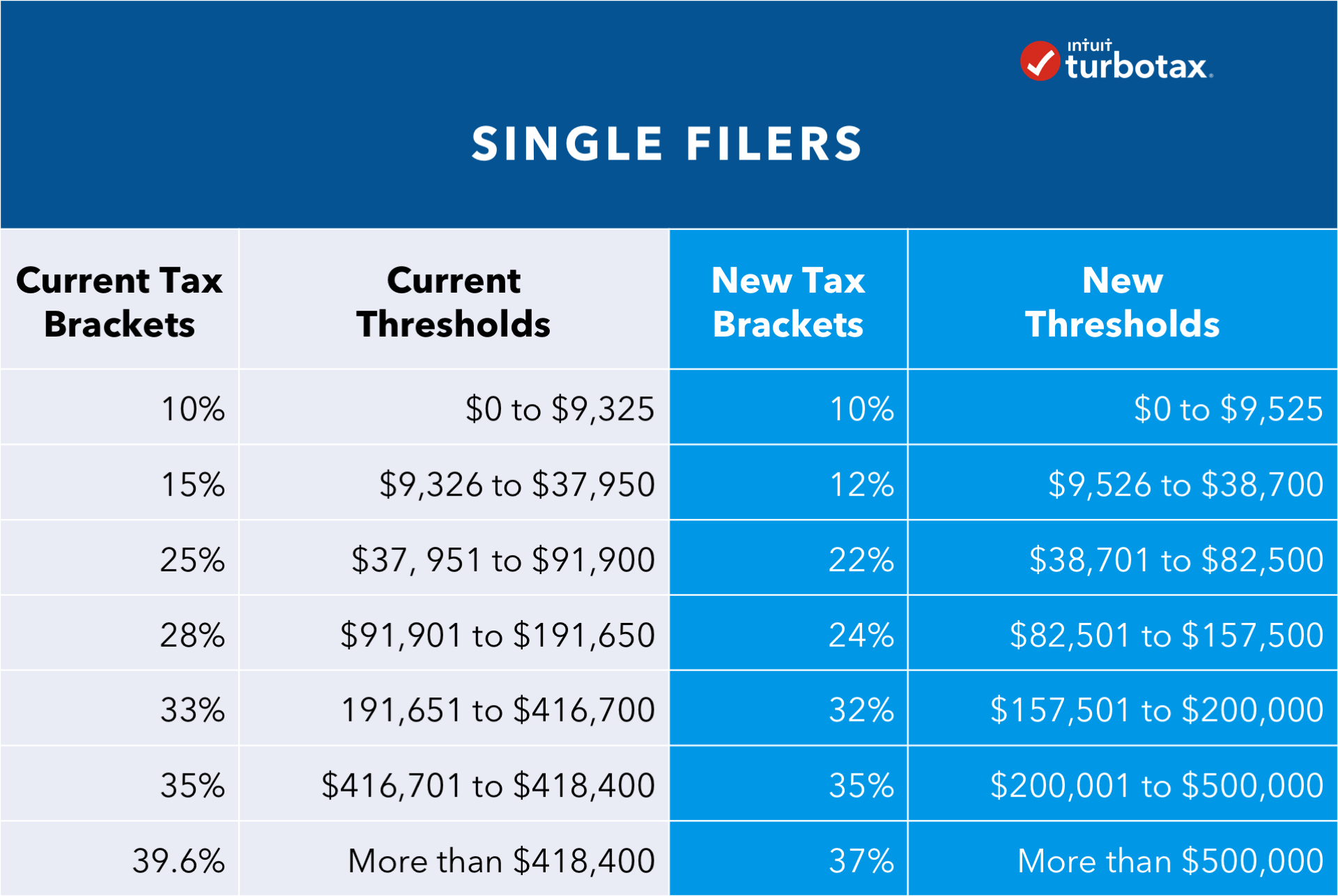

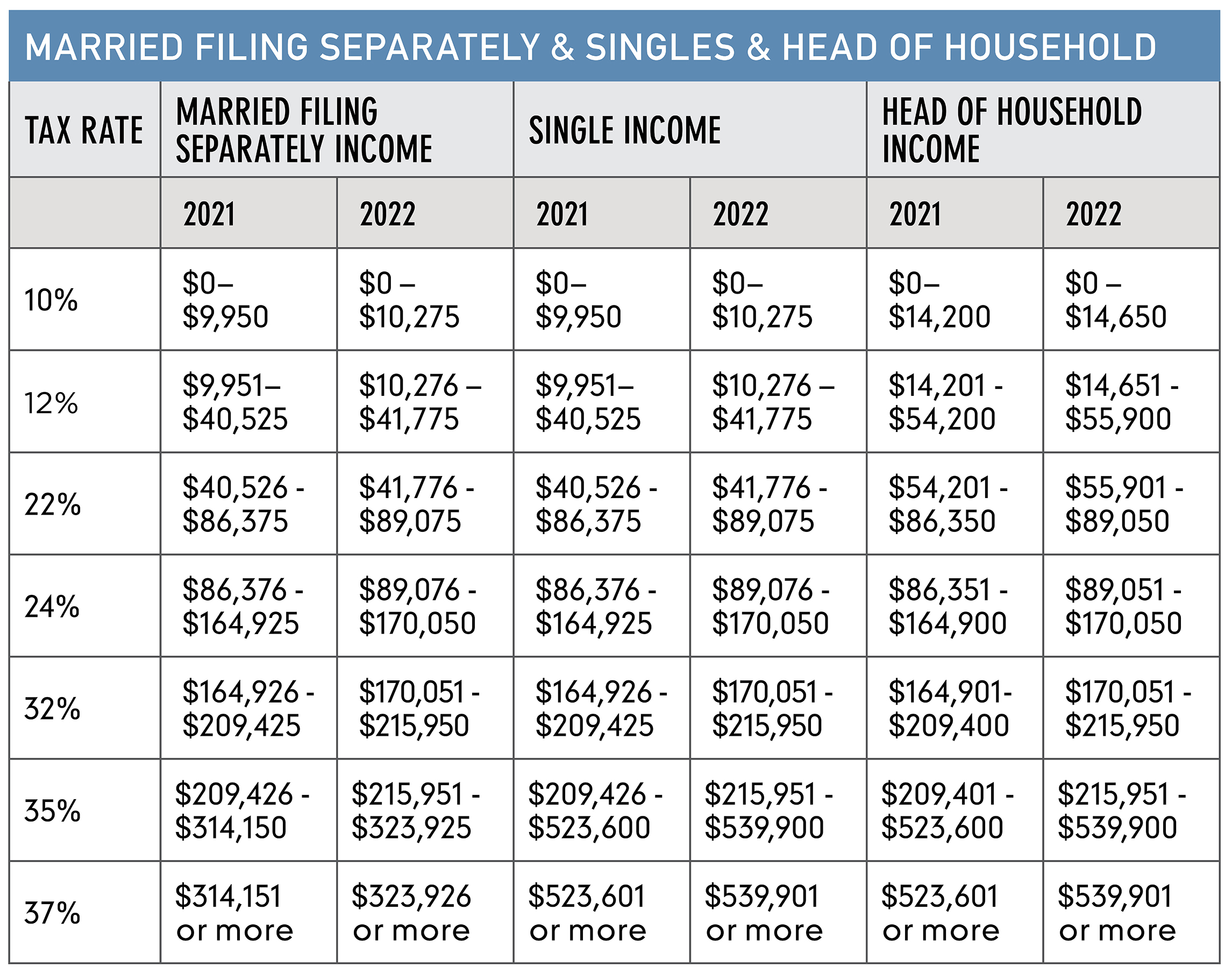

Tax Brackets 2025 Single Filing Modern Present Updated. See current federal tax brackets and rates based on your income and filing status. Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code.

See current federal tax brackets and rates based on your income and filing status. Calculate your personal tax rate. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville For example, if a single filer earns $50,000, only the portion within each bracket is taxed at that rate—10% on income up to $11,610, 12% from $11,610 to $47,060, and 22% above. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: poppyhaleyp.pages.dev

Source: poppyhaleyp.pages.dev

Tax Brackets 2025 Single Head Of Household Poppy P. Haley 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code.

Source: alicalynasl.pages.dev

Source: alicalynasl.pages.dev

2025 Tax Brackets Married Filing Separately Calculator Alica L. Lynas Calculate your personal tax rate. Find the 2025 tax rates (for money you earn in 2025).

Source: matiasbeau.pages.dev

Source: matiasbeau.pages.dev

2025 Tax Brackets Single Filing Matias Beau For example, if a single filer earns $50,000, only the portion within each bracket is taxed at that rate—10% on income up to $11,610, 12% from $11,610 to $47,060, and 22% above. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate).

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville Calculate your personal tax rate. Find the 2025 tax rates (for money you earn in 2025).

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville The old tax regime features progressive tax slabs that vary based on age: Individuals below 60 years have a basic.

Source: catherinekhammond.pages.dev

Source: catherinekhammond.pages.dev

Single Filing Tax Bracket 2025 Catherine K. Hammond Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code. Individuals below 60 years have a basic.

Source: robbivdarlleen.pages.dev

Source: robbivdarlleen.pages.dev

Tax Brackets For 2025 Filing Single Elfie Gilberta The old tax regime features progressive tax slabs that vary based on age: Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

Source: jamesdcrabtree.pages.dev

Source: jamesdcrabtree.pages.dev

Tax Brackets For 2025 Married Filing Jointly With Dependents James D Individuals below 60 years have a basic. Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code.

Source: mikehall.pages.dev

Source: mikehall.pages.dev

2025 Tax Brackets Married Filing Single Mike Hall Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code. The old tax regime features progressive tax slabs that vary based on age:

Source: finngrevilleo.pages.dev

Source: finngrevilleo.pages.dev

2025 Tax Brackets Married Filing Single Finn O. Greville 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.

Source: arturolevi.pages.dev

Source: arturolevi.pages.dev

Tax Brackets For 2025 Vs 2025 Single Arturo Levi Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code. Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027.